Say you’re diligently saving money for your upcoming wedding,eroticism our wounds you plan to own your own business someday, and then in 40 years you want to retire to a beautiful farm. How do you juggle such different financial goals?

Near-term expenditures can be easy to picture and budget for, but long-term goals can seem vaguer and harder to prioritize. Yet the future plans may be the most important ones of all.

“We’re trying to save for our futures; pay off our past, by paying down debt; and live our lives in the present. It’s not easy,” says Liz Weston, a NerdWallet columnist and personal finance expert.

To make it a little easier, follow the rule of saving first for the goal that will happen last. Attack the long-term goals first, and then use your remaining resources toward short-term and intermediate ones, says Molly Balunek, president of Laurel Tree Advisors, a financial and investment planning firm in Cleveland. That way, Balunek adds, you’re “making sure the short-term goals don’t sabotage the long-term ones.”

For example, retirement is a goal that should be a priority for everyone. “[Retirement is] a huge expense, and saving for it shouldn’t be delayed, because the longer you put it off the harder it is to catch up,” Weston says.

Aside from a bucolic idea of farm life (or golf course, or whatever your dream may be), there are many financial incentives to save for retirement. When you contribute to an employer’s 401(k) plan or a traditional or Roth IRA, you’ll enjoy valuable tax breaks and a long investment time horizon for your money to grow.

If you have a 401(k) plan at work, start there. “One rule of thumb for retirement savings is to put away 10% of your gross salary each month,” says Pamela Zedick, a certified financial planner with Zuk Financial Group in Dana Point, California. Some companies match employee contributions dollar for dollar, up to a cap such as 3% or 6%. If 10% is a stretch, aim for at least enough to nab any employer match you’re entitled to.

With savings goals that are five to 10 years out — startup funds for a business, perhaps — you may have only a vague idea of how much you need. Estimating a dollar amount can motivate you to make progress toward the goal.

“The key to building savings … is to develop those goals with great detail and clarity. For example, if you want to start your own business one day, make that mental picture as vivid as possible,” says Cynthia Boman Thompson, a certified financial planner with Cinder Finance in Portland, Ore.

If you create a spreadsheet with dollar estimates for office rental, a website, marketing materials and so on, you may be able to zero in on a specific dollar target, such as $50,000. “Once you have such a vivid picture of what you are trying to achieve, it is usually much easier to stay motivated and stick to your savings plan,” Thompson says.

For intermediate goals, keep the money invested so it has a chance to grow. Consider setting up an automatic electronic funds transfer to a brokerage account, using “for example, a balanced fund that may provide return without too much equity or market risk,” says Charlotte Dougherty, president of Dougherty & Associates, a financial planning firm in Cincinnati.

Short-term goals are usually in sharpest focus. If you want a $4,000 Vera Wang wedding dress and there’s a year to go before you’d have to order it, simply divide the dollar amount by 12 to figure the amount you need to set aside every month. But then consider the impact of that purchase on your intermediate and long-term goals.

You may find you don’t have enough to do everything. That’s when you can start playing with the numbers and making some trade-offs.

“Maybe a $2,000 dress will work, or you retire a couple of years later, or you save $25,000 and take out a small-business loan,” Weston says. “You move the puzzle pieces around to find a combination that works.”

Jeanne Lee is a staff writer at NerdWallet, a personal finance website. Email: [email protected]. Twitter: @jlee_jeanne.

Miami Heat vs. Brooklyn Nets 2025 livestream: Watch NBA online

Miami Heat vs. Brooklyn Nets 2025 livestream: Watch NBA online

In the Mosh Pit, Who Gets to Have Fun, and at Whose Expense?

In the Mosh Pit, Who Gets to Have Fun, and at Whose Expense?

Talking to Madison Smartt Bell About His New Novel, “Behind the Moon”

Talking to Madison Smartt Bell About His New Novel, “Behind the Moon”

Wordle today: The answer and hints for November 10

Wordle today: The answer and hints for November 10

Obama photographer Pete Souza on Trump: 'We failed our children'

Obama photographer Pete Souza on Trump: 'We failed our children'

Looking at “Evidence,” One of the ’70’s Most Influential Photo Books

Looking at “Evidence,” One of the ’70’s Most Influential Photo Books

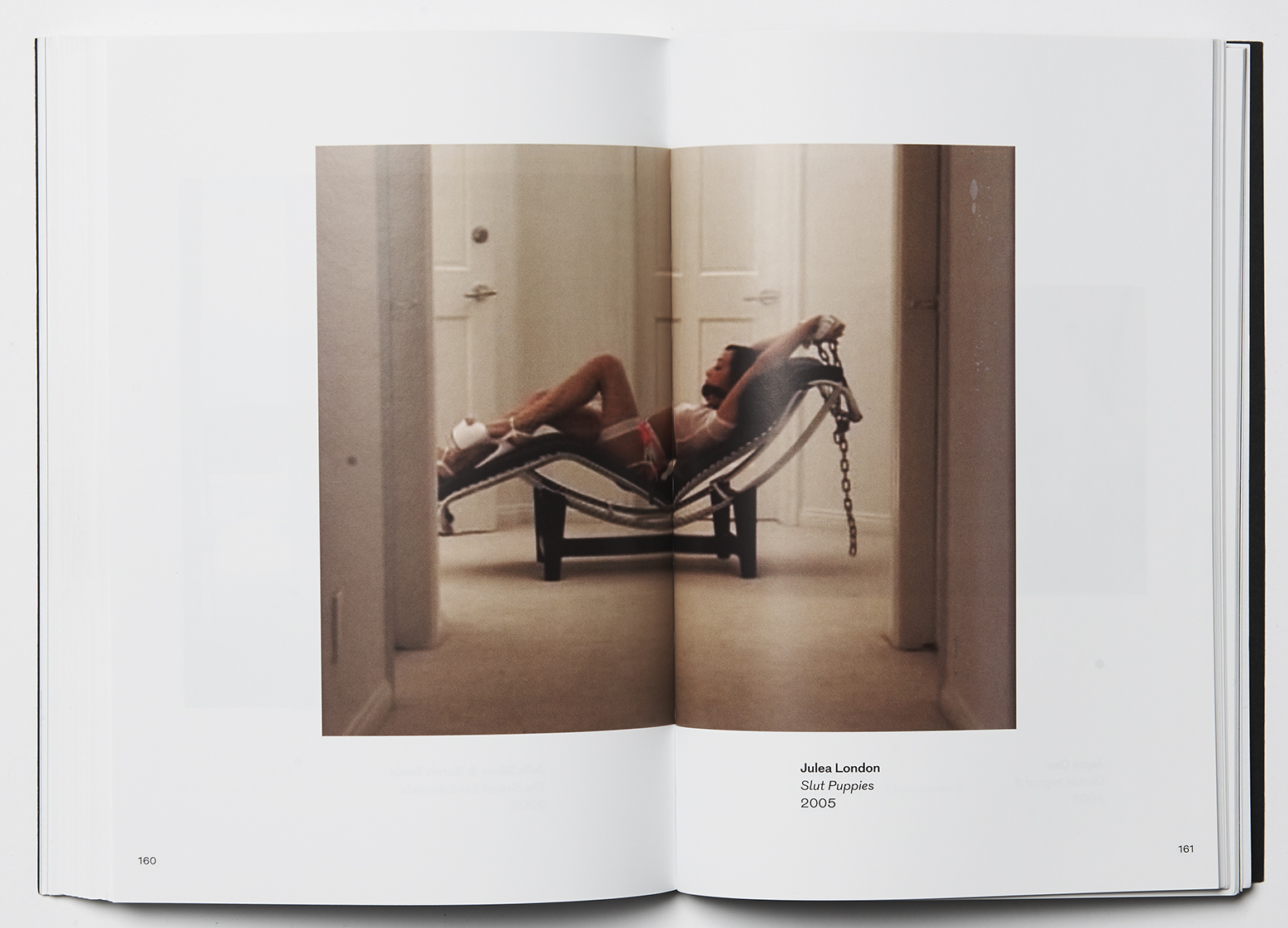

Le Corbusier’s Iconic Chaise Longue Has Changed the Adult

Le Corbusier’s Iconic Chaise Longue Has Changed the Adult

Rules for Consciousness in Mammals: On Clarice Lispector

Rules for Consciousness in Mammals: On Clarice Lispector

Best Samsung Galaxy Watch Ultra deal: Save $200 at Best Buy

Best Samsung Galaxy Watch Ultra deal: Save $200 at Best Buy

Qatar World Cup: FIFA says rainbow colors are allowed in stadiums

Qatar World Cup: FIFA says rainbow colors are allowed in stadiums

We'll always, er, sorta, have the Paris Climate Agreement

We'll always, er, sorta, have the Paris Climate Agreement

Black Friday Nintendo deal: Joy

Black Friday Nintendo deal: Joy

Google and YouTube are investing to fight misinformation

Google and YouTube are investing to fight misinformation

A Painting, Once Looted by Nazis, Returns to the Art Market

A Painting, Once Looted by Nazis, Returns to the Art Market

How to quit social media: This Gen Z

How to quit social media: This Gen Z

Qatar World Cup: FIFA says rainbow colors are allowed in stadiums

Qatar World Cup: FIFA says rainbow colors are allowed in stadiums

You, Too, Can Be T. S. Eliot’s Child. Just Give It a Try.

You, Too, Can Be T. S. Eliot’s Child. Just Give It a Try.

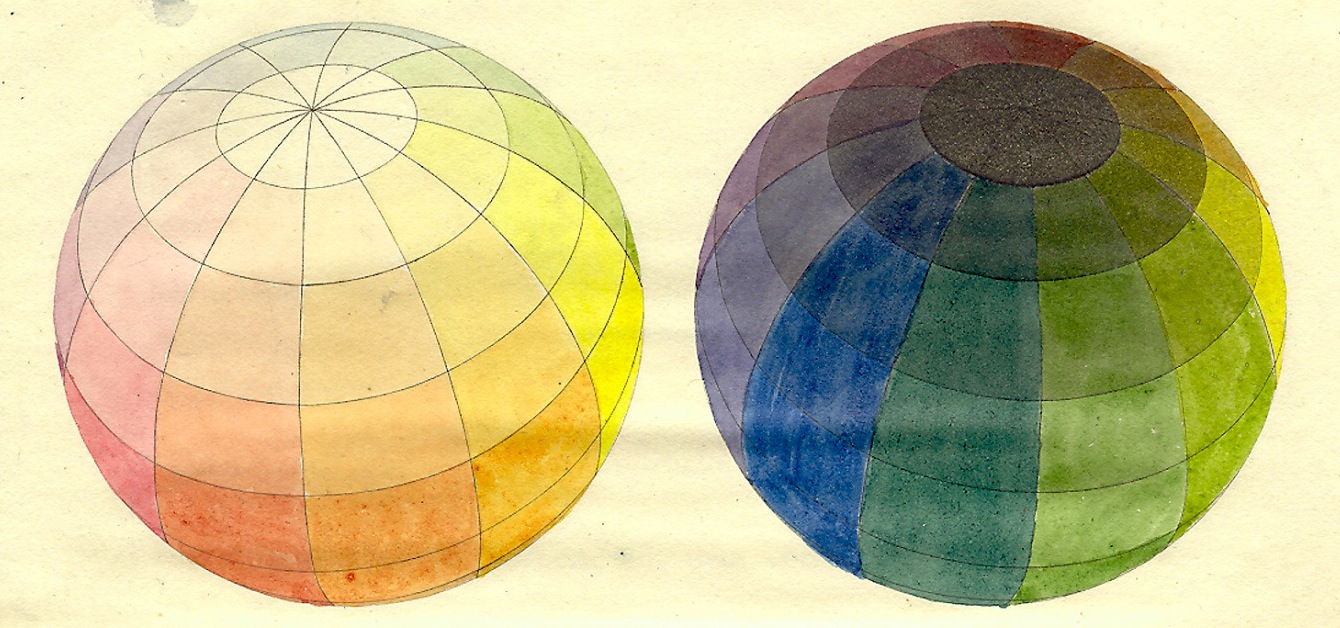

Do Not Let the Robots Name the Colors. The Robots Are Color

Do Not Let the Robots Name the Colors. The Robots Are Color

The Babelio sound machine is for babies. I love it anyway.

The Babelio sound machine is for babies. I love it anyway.

Best earbuds deal: Get the 2023 Amazon Echo Buds for 30% off

Best earbuds deal: Get the 2023 Amazon Echo Buds for 30% off

Remotely hacking elevator phones shouldn't be this easyNewspaper's tweet about climate change and Bubba Gump is too relatableTeenager finds educational software exposed millions of student recordsFacebook sues developers behind malwareJennifer Holliday cancels Trump inauguration performance, apologizes to LGBT communityThe Black Hat cybersecurity conference app has a cybersecurity problemSamsung deleted ads that mocked iPhone for its lack of headphone jackCool kid pranks store by putting his face on every device'Succession' soars higher and hits harder in Season 2: ReviewHow 'Control's mechanics helped shape the supernatural game'Succession' soars higher and hits harder in Season 2: Review'Scary Stories to Tell in the Dark' reanimates your nightmares: ReviewNewspaper's tweet about climate change and Bubba Gump is too relatableAt least 1,000 more buses ask to park for Women's March than Trump's inaugurationSamsung deleted ads that mocked iPhone for its lack of headphone jackSamsung deleted ads that mocked iPhone for its lack of headphone jackJennifer Holliday cancels Trump inauguration performance, apologizes to LGBT communitySeth Rogen uses 1Remotely hacking elevator phones shouldn't be this easyUniversal cancels release of politically charged thriller, 'The Hunt' Today's the day to cuff your Trump Watch Russell Westbrook commit quite possibly the funniest traveling violation in NBA history CBS tried to censor The Rock at the People's Choice Awards and failed miserably Tesla cleared in investigation of fatal Autopilot crash 'Thin doesn't mean unhealthy': Zoo's ridiculous defence of skeletal sun bears Mother responding to herself on Twitter is absolute gold Protesters take over bridges to send a message to Trump Al Gore is a climate change James Bond in urgent, exhilarating 'Inconvenient Sequel' Josh Gad weighs in on 'disturbing' images from 'A Dog's Purpose' A redhead emoji is finally in the cards Donald Trump's official inauguration cups are essentially red Solo cups 14 times J.K. Rowling absolutely annihilated Donald Trump on Twitter Rick Perry regrets calling for abolishment of Energy Department Feds sue student loan giant Navient: What borrowers need to know Try not to tear up reading Obama's farewell letter to America It's inauguration day, so here's a photo of 2 carrots hugging Alec Baldwin reprises Trump impersonation at anti 'Grand Theft Auto' player builds a $1 million car to get justice against trolls His dad founded Chuck E. Cheese. Now he's opening virtual reality fun zones. All your questions answered about Inauguration Day on Twitter

3.0055s , 8287.8984375 kb

Copyright © 2025 Powered by 【eroticism our wounds】,Warmth Information Network